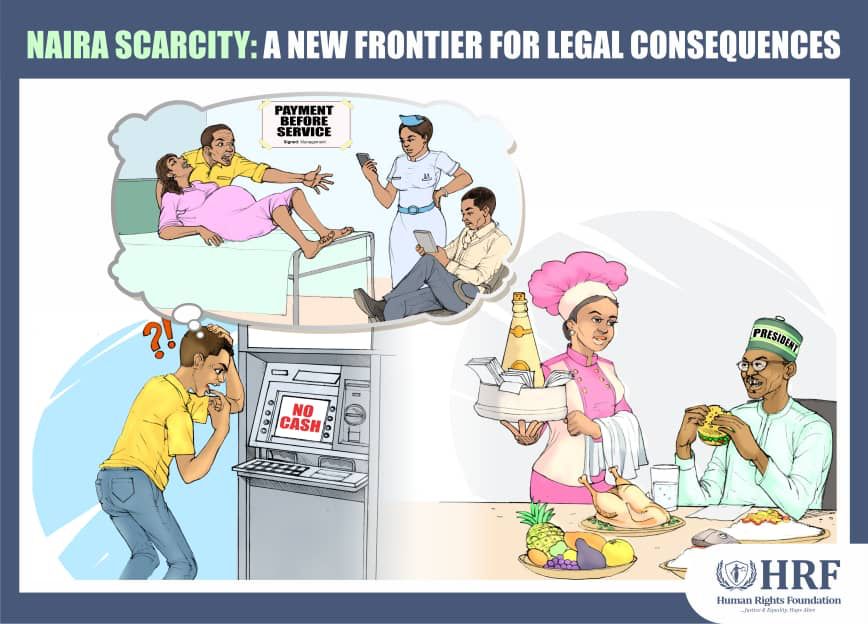

| The consequences of the implementation of the Central Bank of Nigeria (CBN) policy on the new Naira design have been on the lips of Nigerians due to what many describe as poor implementation of the policy. Recall that CBN has announced the deadline for the old Naira Notes, which was initially Jan. 30, then Feb. 10, and has now been extended to Dec. 31, 2023.. It must be noted that the introduction of the new design of the Naira, particularly the N200, N500, and N1000, was also accompanied by the cashless policy. The move placed limitations on the amount of cash an individual or a corporate body is entitled to over the counter. MATTERS ARISING Many issues came to light from the recent naira crisis in Nigeria. The matters ranged from; pending court cases, contempt of courts, buying and selling of naira notes by Point of Sale (POS) Operators, hoarding of the new notes, refusal to accept other forms of payment other than cash by some establishments and organizations, and the subsequent extension of the use of the old N200 notes. REFUSING TO ACCEPT OTHER FORMS OF PAYMENT OTHER THAN CASH According to BarristerNg.com, a pregnant woman died in a Kano Hospital over payment alert delays. It was alleged medical personnel refused to treat the victim, who had been in labor for hours while they waited for a payment alert. This is sad! Considering the cashless policy being implemented by the CBN, it is my humble submission that any organization that refuses to accept other forms of payment other than cash could be held liable for negligence if their failure to accept alternative payments results in injury to the aggrieved party. Hence, such an organization owes a duty of care to their customers to accept any form of payment acceptable in Nigeria in compliance with the CBN policies. CONTEMPT OF COURT Despite the March 3 supreme court ruling that was filed by some All Progressive Congress (APC) governors against the federal government, which described the CBN’s policy as ill-advised and illegal, Nigerians are still reeling from the lives lost and the collapse of businesses across the country. It is important to state that it is doubtful the president can be held liable for contempt due to the absolute immunity of the office of the Presidency as encapsulated under section 308 of the Constitution of the Federal Republic of Nigeria 1999(as amended). As a result, the president or a governor cannot be arrested or imprisoned while in office by the above provisions. However, where a president misconducts himself, he can be impeached. See section 143 of the Constitution of the Federal Republic of Nigeria 1999 ( as amended). While the Nigerian populace seeks justice, remedy, and accountability for their woes, life has not returned to normal yet. As a result, the legal consequences of the botched CBN policy will remain a thorn in the side of the federal government for years to come. |

|

| HRF facilitated the release of indigent client, Treasure Oko on March 9, 2023, at an Ondo State High Court, after awaiting trial and incarcerated for 4 years. The case was struck out for want of diligent prosecution. L-R: HRF-West Regional Coordinator, A.Y. Aliyu, and Treasure Oko. |

|

| HRF facilitated the release of indigent client, Sodiq Moshood on March 13, 2023, at a Lagos State High Court, after awaiting trial and incarcerated for 7 years. The case was struck out after prosecution failed to establish a prima facie against the defendant. HRF started representing Mr. Moshood in 2022. L-R: Sodiq Moshood, and HRF Legal Associate, Ni’mah Ali. |

.jpg)

0 Comments