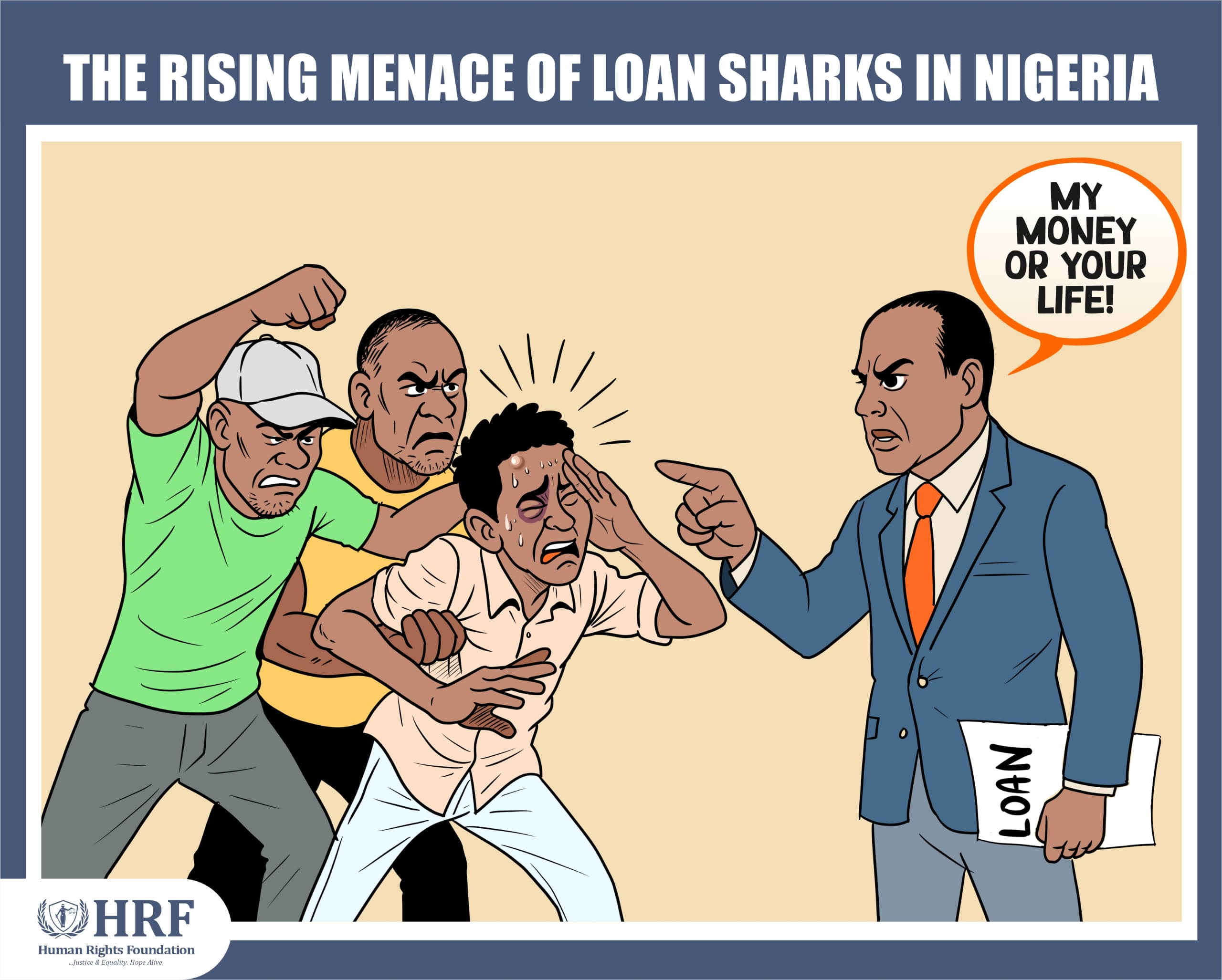

On the evening of 22nd June 2025, a disturbing incident unfolded in Akure that underscores a growing crisis in the operations of microfinance institutions and informal loan recovery practices across Nigeria. A young man, alleged to have defaulted on a loan repayment, was on his way home when a group of over twenty men accosted him. These men, acting in apparent collaboration with a staff member of ASHA Microfinance Bank, Oke-Ijebu, Akure, harassed, intimidated, and physically assaulted him in public.

According to eye-witness accounts and the victim's testimony, the staff of the bank, whose name remains unknown, placed a call to one Sulieyat, another known employee of ASHA Microfinance Bank, to verify the man's identity. Moments later, the thugs forcibly attempted to take the young man to his residence. When he resisted, he was brutally beaten and molested. In the chaos that followed, personal items in his possession, including a mobile phone, a gold chain, and some cash, went missing. The matter was formally reported to the Nigeria Police Force, Area Command, Akure, and following intervention, some arrests were made. While the staff involved appeared to have acted without the formal authority of the bank, the incident reflects an alarming pattern.

What transpired is not an isolated case. Across Nigeria, a disturbing trend has emerged where moneylenders, especially loan sharks operating through digital lending apps, resort to shame, coercion, and outright criminality in a bid to recover unpaid debts. Many Nigerians have reported being defamed publicly by these lenders who, upon default, access their phone contacts and send malicious messages to friends, family members, and employers.

Some victims are branded as fraudsters in WhatsApp groups and Facebook posts; others receive threatening messages containing private photographs or sensitive personal information. These practices violate not only human decency but fundamental rights enshrined in the Nigerian Constitution, particularly the right to dignity and privacy under Sections 34 and 37, respectively.

Loan default, while unfortunate, is a civil matter. It does not warrant harassment, assault, or criminalization. There are established legal channels for debt recovery, including court proceedings, demand letters, and negotiated settlements. When financial institutions, whether formal banks or digital loan providers, bypass these channels and employ violence or public ridicule, they break the law and perpetuate a cycle of fear and injustice.

This recent incident involving ASHA Microfinance Bank is a grim reminder that if urgent regulatory enforcement is not deployed, the growing impunity of micro-lenders will continue to endanger lives and undermine public confidence in financial services. It is the duty of regulatory bodies such as the Central Bank of Nigeria, the Federal Competition and Consumer Protection Commission (FCCPC), and the National Information Technology Development Agency (NITDA) to investigate these reports and take decisive action.

No Nigerian should have to fear for their safety or dignity because they borrowed money. The right to borrow must be matched with the right to be treated lawfully, even in default. Violence, intimidation, and data abuse must never be allowed to replace due process.

.jpg)

0 Comments